The Efficient Market Hypothesis (EMH) is an economic theory that posits that financial markets are “informationally efficient,” meaning that asset prices accurately reflect all available information about those assets. In other words, it is not possible for an investor to consistently achieve higher returns than the market average by using information that is already publicly available. The EMH is an important lens through which to view financial markets, but it remains a model that cannot fully describe reality. There are many exceptions (or anomalies) that should not exist if the EMH perfectly described reality. Examples include:

- Small Firm Effect: It has been shown that smaller companies generally offer higher returns than larger ones, contradicting the expectations stemming from the EMH.

- Value Premium: Value stocks have been shown to generally yield higher returns than growth stocks, again contradicting the expectations of the EMH.

- Momentum Effect: The momentum effect suggests that stocks that have performed well in the recent past will continue to perform well in the future, which is an anomaly because it suggests that future prices depend not only on current information but also on past performance.

- Calendar Anomalies: Various calendar-related anomalies have been observed, such as the so-called “January effect,” where stocks tend to perform better in January than in other months.

- Anomalies in Emerging Markets: Several anomalies have been observed in emerging markets, such as the “home bias,” where investors prefer to invest in their own country despite sometimes better-performing investments in other countries.

As more money flows into a market and there are fewer barriers (such as capital controls or short-selling restrictions) for market participants, the market becomes more efficient. Hersh Grossman and Joseph Stiglitz developed the Grossman-Stiglitz model in the 1970s to explain why financial markets are not always perfectly efficient. They attribute inefficiencies to limited information and transaction costs.

According to this model, it is possible that investors may not have the correct information or may not be able to process that information, leading to asset prices not always reflecting the truth. Moreover, high transaction costs can prevent investors from trading based on their information, making prices not always efficient.

The Grossman-Stiglitz model is important because it highlights some of the flaws in the Efficient Market Hypothesis and suggests that there may be factors that hinder the efficiency of financial markets. The model offers a more realistic view of financial markets.

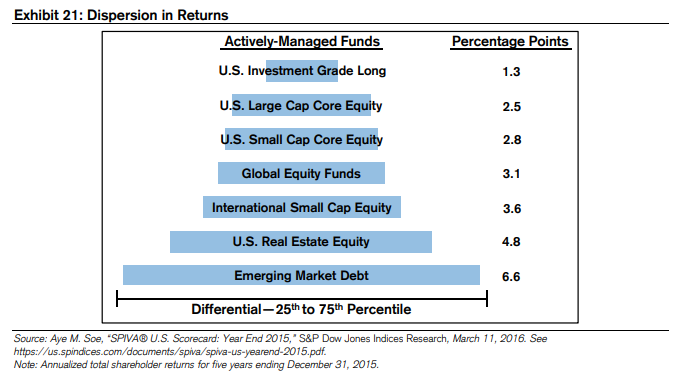

In 2015, Michael Mauboussin, then employed at Credit Suisse, published an interesting paper titled “Looking for Easy Games: How Passive Investing Shapes Active Management.” I extracted the following chart that illustrates the spread between the top 20% fund managers and the bottom 33% over the past five years. He compared managers across seven different asset classes:

What the chart shows is that the spread naturally increases as the degree to which a market is likely to adhere to the EMH (Efficient Market Hypothesis) grows. When competition in the market is consistently lower, there is more room for skilled managers to achieve outstanding results, and vice versa.

I played professional poker for a long time, and in that world, the conventional wisdom is that you could be the 10th best player in the world, but if you sit down at a table with the nine best players, your skill won’t be of much use in the end. Humility about your abilities is more important than the absolute level of technical skill.

The on-the-run Treasury markets, major currency markets, the S&P 500, and the Nasdaq are examples of the strongest markets in the world, often referred to as the “toughest games.” For instance, Mauboussin’s chart illustrates that emerging market bonds and tradeable U.S. real estate are much easier games. The latter is particularly interesting. Intuitively, I imagine that real estate funds can achieve relatively good results because it’s a segment that is consistently avoided by most professional investors for various reasons.

Micro-cap companies are not on the chart, but they are likely an even richer ground for skilled managers to make a difference. It also seems logical that other niche markets such as distressed debt, frontier bond markets, or emerging markets like cryptocurrencies offer more opportunities for outperformance by talented managers.